Understand the BPRA configuration

The BVG (occupational pension), a retirement savings scheme that supplements AHV contributions and helps to maintain the pre-retirement standard of living, an essential component of employees' retirement in Switzerland. This article summarizes how to configure the LPP in Odoo V17.

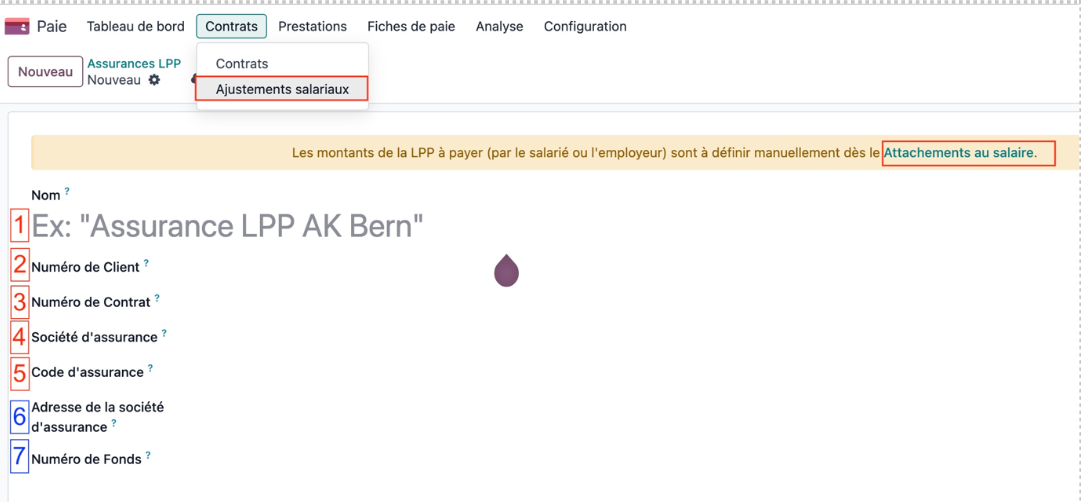

Configuration of the BPP insurance

To configure the PPL, go to Pay >> Configuration >> PPL Insurance.

Create your new policy, fill in the mandatory and optional fields. Below is an example of a LPP contribution.

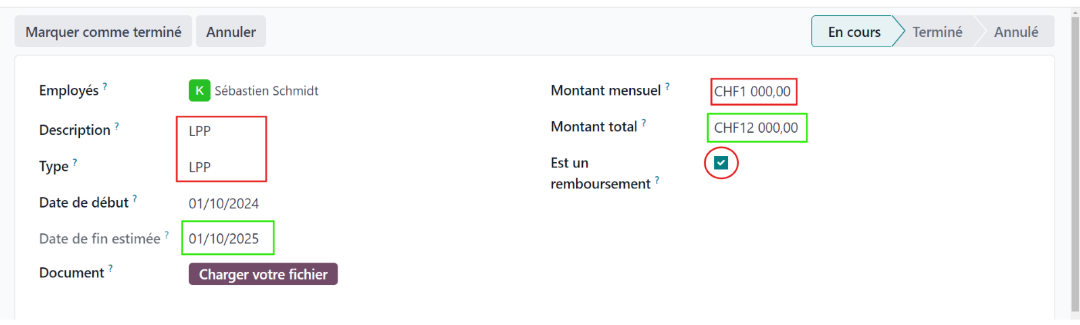

Once all these fields have been filled, create two salary adjustments (one for the employee and one for the employer).

Below is an example of an employee adjustment (the green box amounts depend on each other. The end date of the adjustment will automatically be calculated based on the monthly amount and total amount)

Practical advices

Be sure to check the box " Is a refund " so that you have the amount deducted from salary when setting up the employee’s contribution.

Once the BVG adjustment is configured, do the same with the employer adjustment, correcting the type of adjustment, the nature of the adjustment (is not a refund)

Conclusion

And there you have it, you have set up an employee’s BVG contributions!😉

You just have to set up this contribution for all your employees, and that’s it!

For more information, ask for the Nalios Pay module configuration guide! And to go further, do not hesitate to view our tutorial on YouTube by clicking here